Business

Alternative Investments: Charting a New Course for Financial Success

Introduction

Alternative investments encompass a broad range of assets that do not fall into traditional categories like stocks, bonds, or cash. These investments are increasingly gaining prominence as investors seek diversification and higher returns. Unlike conventional investments, alternatives offer unique opportunities and risks, making them a vital component of modern portfolios. For those looking to deepen their understanding of these options, Go https://bitalpha-ai.com offers comprehensive educational resources that can provide valuable insights.

Understanding Alternative Investments

Types of Alternative Investments: Alternative investments include private equity, hedge funds, real estate, commodities, cryptocurrencies, and collectibles. Each category offers distinct benefits and challenges. Private equity involves investing directly in private companies or buyouts, while hedge funds use various strategies to achieve high returns. Real estate investment can be direct (buying property) or indirect (through REITs or crowdfunding). Commodities involve physical goods like gold or oil, cryptocurrencies are digital assets like Bitcoin, and collectibles include items like art or antiques.

Historical Context: Historically, alternative investments were accessible mainly to wealthy individuals and institutional investors. However, the evolution of financial markets and technology has broadened access. The global financial crisis of 2008 highlighted the need for diversification, accelerating interest in alternatives.

Advantages of Alternative Investments

Diversification Benefits: Alternatives often have low correlations with traditional asset classes, which can reduce overall portfolio risk. For example, real estate might not move in tandem with stock market fluctuations, providing stability during market downturns.

Potential for Higher Returns: Alternatives can offer higher returns compared to traditional investments. Private equity and hedge funds, for instance, often target higher growth opportunities. Historical data shows that certain alternatives have outperformed traditional markets, although this is not guaranteed.

Inflation Hedge: Assets like commodities and real estate can serve as hedges against inflation. Commodities, such as gold, typically retain value when inflation rises, while real estate tends to appreciate over time, preserving purchasing power.

Risks and Challenges

Market Risks: Alternative investments can be volatile. For instance, cryptocurrencies are known for significant price swings, which can lead to substantial losses. Real estate markets are also subject to economic cycles, impacting property values.

Due Diligence: Thorough research is crucial when investing in alternatives. Unlike publicly traded assets, alternatives often lack transparency and detailed information. Investors need to evaluate the management team, market conditions, and potential returns before committing.

Regulatory and Transparency Issues: Many alternative investments are less regulated than traditional ones. Hedge funds and private equity, for example, operate with fewer regulatory constraints, which can increase risk. Investors must be cautious about the lack of oversight and ensure they understand the investment’s structure and terms.

Popular Types of Alternative Investments

Private Equity: Private equity involves investing directly in private companies or taking public companies private. This category includes venture capital (investing in startups) and buyouts. Private equity can offer high returns but requires a long-term commitment and involves higher risk.

Hedge Funds: Hedge funds employ a variety of strategies, including long/short equity, global macro, and event-driven approaches. They aim to generate high returns regardless of market conditions. While they offer potential for significant gains, they also come with high fees and complexity.

Real Estate: Real estate investments include buying residential or commercial properties or investing through REITs. REITs provide a way to invest in real estate without owning physical property. Real estate can provide steady income and appreciation, though it requires active management and can be illiquid.

Commodities: Investing in commodities involves trading physical goods or commodity futures. Gold, oil, and agricultural products are common commodities. These investments can act as a hedge against inflation and offer diversification but can be volatile and influenced by global events.

Cryptocurrencies: Digital assets like Bitcoin and Ethereum represent a new class of investments. Cryptocurrencies are decentralized and can offer high returns, but they are highly speculative and face regulatory uncertainty.

Collectibles: Collectibles include items like art, rare coins, and vintage cars. These investments can be valuable due to their rarity and historical significance. However, they require specialized knowledge and can be illiquid and difficult to value.

Strategies for Investing in Alternatives

Asset Allocation: Incorporating alternative investments into a portfolio requires careful asset allocation. Investors should balance traditional and alternative assets based on their risk tolerance, investment goals, and time horizon.

Risk Management: Managing risks in alternative investments involves diversification within the asset class and regular monitoring. For example, diversifying within real estate by investing in different property types or locations can mitigate risk.

Investment Horizon and Liquidity: Alternatives often have longer investment horizons and lower liquidity compared to traditional investments. Investors should ensure they can commit capital for the required period and consider their liquidity needs when choosing alternatives.

The Future of Alternative Investments

Emerging Trends: Innovations such as blockchain technology and artificial intelligence are shaping the future of alternative investments. Blockchain can enhance transparency and efficiency, while AI can provide advanced analytics for better investment decisions.

Impact of Technology: Technology is making alternative investments more accessible and efficient. Online platforms and fintech developments are lowering barriers to entry, enabling more investors to participate in previously inaccessible asset classes.

Case Studies and Success Stories

Successful Alternative Investment Strategies: Examples include the rise of tech-focused venture capital firms that have achieved high returns through early investments in companies like Facebook and Uber. Real estate investments in high-growth urban areas have also yielded significant profits.

Lessons Learned: Successful alternative investments often involve a combination of thorough research, long-term commitment, and strategic diversification. Investors should learn from these examples to develop robust investment strategies.

Conclusion

Alternative investments offer unique opportunities and challenges. By understanding their types, benefits, risks, and future trends, investors can better navigate this dynamic field. Incorporating alternatives into a diversified portfolio can enhance financial success and resilience against market fluctuations. As always, careful consideration and research are key to making informed investment decisions.

Business

Independent brewers join call for business rates relief as pub closures feared

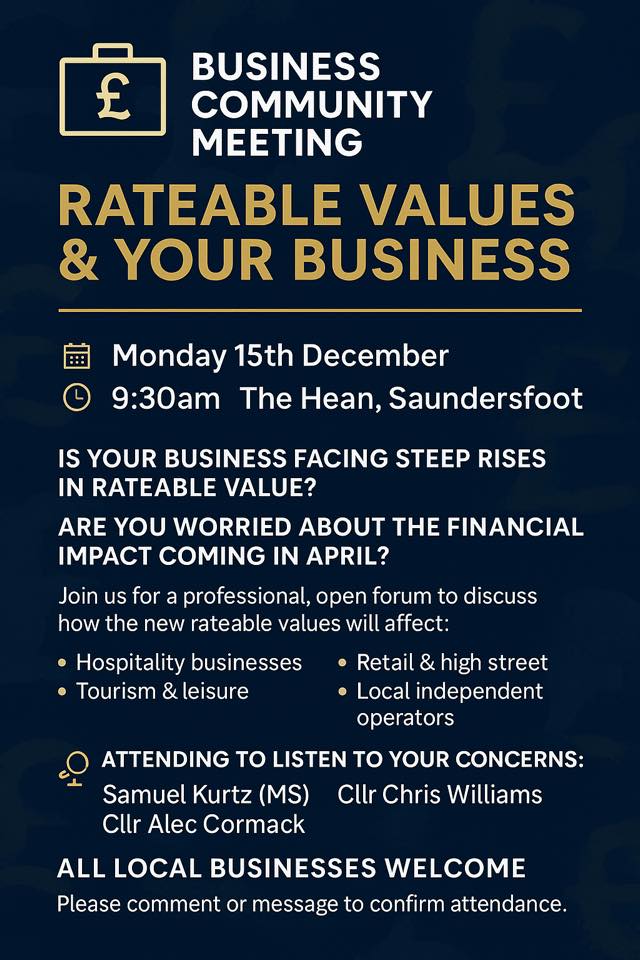

INDEPENDENT brewers have joined growing calls for urgent, pub-specific relief on Business Rates amid fears that community pubs across west Wales and beyond could be forced to close.

The Society of Independent Brewers and Associates (SIBA) has warned that changes announced in the Autumn Budget will see pub costs rise sharply over the next three years, with the average pub facing a 76% increase in Business Rates. By comparison, large warehouse-style premises operated by online and technology giants are expected to see increases of around 16%.

The issue will be discussed at a meeting taking place on Monday in Saundersfoot, where local publicans, small brewers and business representatives are due to come together to examine the impact of rising Business Rates and escalating operating costs. The meeting is expected to focus on the future sustainability of community pubs, particularly in coastal and rural areas where they often act as vital social hubs as well as key local employers.

Independent breweries are particularly exposed, SIBA says, as the vast majority of their beer is sold through local community pubs. Many small breweries also operate their own pubs or taprooms, meaning they are hit twice by rising rates. Some independent brewers have reported rateable value increases of up to 300%, creating new costs they say will be extremely difficult to absorb.

New industry research published on Thursday (Dec 12) suggests that introducing a pub-specific Business Rates relief of 30% from April 1, 2026 could protect around 15,000 jobs currently under threat in the pubs sector and help prevent widespread closures.

The call for action follows an open letter sent last week by SIBA’s board, expressing deep concern at the impact of the Budget’s Business Rates decisions on the hospitality sector.

Andy Slee, Chief Executive of SIBA, said: “The last orders bell is ringing very loudly in our community pubs after the shock changes to Business Rates in the Budget.

“Publicans and brewers feel badly let down by a system that still isn’t fairly addressing the imbalance between big global tech companies and small business owners.

“We were promised proper reform of Business Rates in the Labour manifesto last year and a rebalancing of the tax regime, but this has not been delivered. Pubs therefore need urgent help to address the planned increase in costs through a pub-specific relief, followed by full and meaningful reform.”

Those attending Monday’s meeting in Saundersfoot are expected to consider how local voices can feed into the national debate and press for urgent action to protect community pubs across Pembrokeshire.

Business

Cosheston Garden Centre expansion approved by planners

PLANS to upgrade a garden centre on the main road to Pembroke Dock have been given the go-ahead.

In an application to Pembrokeshire County Council, submitted through agent Hayston Developments & Planning Ltd, Mr and Mrs Wainwright sought permission for upgrade of a garden centre with a relocated garden centre sales area, additional parking and the creation of ornamental pond and wildlife enhancement area (partly in retrospect) at Cosheston Garden Centre, Slade Cross, Cosheston.

The application was a resubmission of a previously refused scheme, with the retrospective aspects of the works starting in late 2023.

The site has a long planning history, and started life as a market garden and turkey farm in the 1980s, and then a number of applications for new development.

A supporting statement says the previously-refused application included setting aside a significant part of the proposed new building for general retail sales as a linked farm shop and local food store/deli in addition to a coffee bar.

It was refused on the grounds of “the proposal was deemed to be contrary to retail policies and the likely impact of that use on the vitality and viability of nearby centres,” the statement said, adding: “Secondly, in noting that vehicular access was off the A 477 (T) the Welsh Government raised an objection on the grounds that insufficient transport information had been submitted in respect of traffic generation and highway safety.”

It said the new scheme seeks to address those issues; the development largely the same with the proposed new garden centre building now only proposed to accommodate a relocated garden centre display sales area rather than a new retail sales area with other goods, but retaining a small ancillary coffee bar area.

“Additional information, in the form of an independent and comprehensive Transport Statement, has now been submitted to address the objection raised by the Welsh Government in respect of highway safety,” the statement said.

It conceded: “It is acknowledged that both the creation of the ornamental pond and ‘overspill’ parking area do not have the benefit of planning permission and therefore these aspects of the application are ‘in retrospect’ and seeks their retention.”

It finished: “Essentially, this proposal seeks to upgrade existing facilities and offer to the general public. It includes the ‘relocation’ of a previously existing retail display area which had been ‘lost’ to the ornamental pond/amenity area and to provide this use within the proposed new building and moves away from the previously proposed ‘farm shop’ idea which we thought had merit.

“This revised proposal therefore involves an ‘upgrading’ rather than an ‘expansion’ of the existing garden centre use.”

An officer report recommending approval said that, while the scheme would still be in the countryside rather than within a settlement boundary, the range of goods sold would be “typical of the type of goods sold in a garden centre and which could be sold elsewhere within the garden centre itself,” adding: “Unlike the recent planning application refused permission it is not intended to sell delicatessen goods, dried food, fruit and vegetables, pet products and gifts.”

It added that a transport statement provided had been reviewed by the Welsh Government, which did not object on highway grounds subject to conditions on any decision notice relating to visibility splays and parking facilities.

The application was conditionally approved.

Business

Tenby Poundland site could become retro gaming lounge

TENBY’S former Poundland and Royal Playhouse cinema could become a retro computer gaming lounge, plans submitted to the national park hope.

Following a takeover by investment firm Gordon Brothers, Poundland shut 57 stores earlier this year, including Tenby.

Prior to being a Poundland, the site was the Royal Playhouse, which had its final curtain in early 2011 after running for nearly a century.

The cinema had been doing poor business after the opening of a multiplex in Carmarthen; in late 2010 the opening night of the-then latest Harry Potter blockbuster only attracted an audience of 12 people.

In an application to Pembrokeshire Coast National Park, Matthew Mileson of Newport-based MB Games Ltd, seeks permission for a ‘CONTINUE? Retro Gaming Lounge’ sign on the front of the former Gatehouse (Playhouse) Cinema, White Lion Street, most recently used as a Poundland store.

The signage plans form part of a wider scheme for a retro gaming facility at the former cinema site, which has a Grade-II-listed front facade, a supporting statement through agent Asbri Planning Ltd says.

“The subject site is located within the settlement of Tenby along White Lion St. The site was formerly the Gatehouse Cinema and currently operates as a Poundland discount store, which closed on October 18.”

It adds: “This application forms part of a wider scheme for the change of use to the former Gatehouse Cinema. Advertisement consent is sought for a non-illuminated aluminium composite folded panel that will be bolted onto the front façade of the proposed building, in replacement of the existing signage (Poundland).”

It stresses: “It is considered that the proposed advertisement will not have a detrimental impact on the quality of the environment, along with being within a proportionate scale of the building. It is considered that the proposed signage will reflect site function.

“Furthermore, due to the sympathetic scale and design of the sign itself, it is considered that the proposal will not result in any adverse visual amenity impacts.

“The proposal is reduced in sized compared to the existing Poundland advertisement. The sign will not be illuminated. Given the above it is considered that such proportionate signate in association with the proposed retro gaming lounge is acceptable and does not adversely affect visual amenity.”

An application for a retro gaming lounge by MB Games Ltd was recently given the go-ahead in Swansea.

-

Crime5 days ago

Crime5 days agoPhillips found guilty of raping baby in “worst case” judge has ever dealt with

-

Crime4 days ago

Crime4 days agoKilgetty scaffolder sentenced after driving with cocaine and in system

-

Crime4 days ago

Crime4 days agoHousing site director sentenced after failing to provide breath sample following crash

-

Crime4 days ago

Crime4 days agoMotorist banned for three years after driving with cannabis in system

-

Education3 days ago

Education3 days agoTeaching assistant struck off after asking pupil for photos of her body

-

News6 days ago

News6 days agoJury retires tomorrow in harrowing Baby C rape trial

-

Crime4 days ago

Crime4 days agoMilford Haven pensioner denies exposure charges

-

Crime22 hours ago

Crime22 hours agoMan spared jail after baseball bat incident in Milford Haven