Business

Community to rally against Tata Steel job cuts in Port Talbot

PROTESTORS are set to gather outside the Port Talbot Jobcentre Plus, making a stand against the proposed job cuts by Tata Steel that threaten to devastate the local community. The rally, scheduled for Wednesday, 28 February 2024, from 1 pm to 2 pm, aims to draw attention to the potential destruction of Port Talbot’s social and economic fabric if the company proceeds with its plan to lay off 2,500 steelworkers and shut down the town’s blast furnaces permanently.

This demonstration is a critical part of Unite the Union’s broader campaign to compel Tata Steel to reconsider its decision, a move that is also receiving strong support from members of the Public and Commercial Services (PCS) Union employed at the jobcentre. The gathering will take place at the Jobcentre Plus located at 64-66 Station Road, Port Talbot, SA13 1LX, with organisers promising comprehensive photo and video coverage upon request.

The protesters aim to vividly portray the bleak future awaiting Port Talbot should Tata’s current proposals come to fruition, drawing parallels to the long-term suffering endured by coalfield communities across England and Wales in the wake of mine closures. These areas continue to grapple with diminished employment opportunities, heightened unemployment, deteriorating health outcomes, and an increased dependency on social benefits.

Sharon Graham, Unite’s General Secretary, expressed a determined stance against the looming economic calamity, reminiscent of the plight that befell Britain’s coal mining towns. “The fight to prevent Port Talbot from enduring similar economic devastation is urgent,” she asserted. Graham remains optimistic about the UK steel industry’s prospects, citing the success of its counterparts in Germany, France, and the Netherlands, contingent on the right mix of support and strategic decisions. Unite is poised to escalate its efforts by initiating a strike ballot among its Tata members next week and leveraging all available means to pressure the company and political leaders to abandon their current plans.

Echoing Unite’s sentiments, PCS General Secretary Fran Heathcote extended unwavering solidarity to the workers at risk of redundancy due to the closure of Port Talbot’s blast furnaces. Heathcote criticised the move as an act of “industrial vandalism” and highlighted the ripple effects it would have, not only on the directly affected employees but also on the PCS members working in jobcentres and the broader community. The jobcentre staff, already under significant strain, face the daunting prospect of accommodating thousands of additional claimants, further exacerbating the challenges within the beleaguered town.

As Port Talbot stands on the brink of an uncertain future, the upcoming rally symbolises a critical juncture in the community’s fight against industrial decline, urging both Tata Steel and the government to chart a more compassionate and sustainable course forward.

Business

Computer Solutions Wales under fire from customers

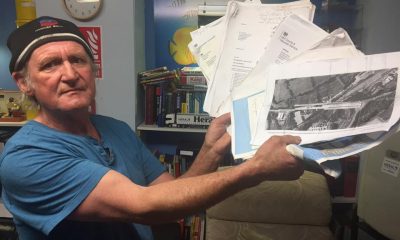

Claims of unreturned devices, unpaid refunds and small claims court cases as company blames landlord dispute

CUSTOMERS across west Wales have raised concerns about the trading activities of Computer Solutions Wales, alleging unpaid refunds, missing computers and prolonged periods of poor communication.

The Herald has spoken to several individuals who say they handed over laptops or desktop computers for repair or replacement, paid hundreds or in some cases thousands of pounds, and were then left without their property or a refund despite repeated attempts to resolve the matter.

In some cases, those affected say they have pursued the issue through the civil courts.

Court action taken

One customer said he handed over two custom-built desktop PCs for repair on Sunday (Mar 30, 2025) and later paid £710 after being told the work was complete. He says the computers were never returned.

After months of chasing, he took the matter to court. A hearing took place in October 2025, which he says the defendant did not attend. The court ruled in his favour and issued an order in November for the return of the two computers and repayment of £377 in court fees.

He says that deadline has since passed and the computers remain outstanding.

Other customers described similar experiences, including payments for repairs or replacement equipment followed by delays, cancelled appointments and repeated assurances that items would be returned or refunds processed.

Several said they were eventually advised to pursue claims through the small claims court.

One former worker also alleged unpaid wages during a period of employment.

The Herald has seen copies of text messages, payment confirmations and court paperwork relating to some of the complaints.

Company status questions

Companies House records show that Computer Solutions Pembs Ltd, the limited company associated with the business, was dissolved on Tuesday (July 29, 2025) following compulsory strike-off proceedings.

Filings show changes to directors and persons with significant control in the months before dissolution, along with a change of registered office address outside Wales.

Under company law, a dissolved limited company cannot trade or enter into new contracts.

Despite this, services continued to be advertised online under the Computer Solutions Wales name, including through a website and social media pages. Some customers told The Herald they believed they were dealing with an active limited company at the time they made payments.

Trading history

Archived photographs, marketing material and social media posts seen by The Herald show the Computer Solutions Wales name has been used publicly for several years, including from a high street premises in Pembrokeshire and in promotional material dating back to 2022.

Customers said they understood Computer Solutions Wales to be an established local business operating under the same branding throughout that period.

Police response

Dyfed-Powys Police confirmed they had reviewed information provided to them about the complaints.

In correspondence seen by The Pembrokeshire Herald, police said the matters raised did not constitute a criminal investigation and appeared to relate to civil liability and potential consumer protection issues. Complainants were advised to contact Trading Standards and pursue enforcement through the civil courts where appropriate.

Company response

Steven Grant, trading as Computer Solutions Wales, was contacted and offered the opportunity to comment. Publication of this article was delayed by one week to allow time for a response.

In a written holding statement, a spokesperson for the business said the issues stemmed from a dispute with a former landlord.

The statement said: “This issue began when Computer Solutions Wales was in dispute with its then landlord over building repair obligations and subsequent rent requirements.

“Since then, the landlord has denied CSW access to the property which contains a number of computers. These computers do not belong to CSW nor the landlord, but to CSW customers.

“CSW does not understand the legal position regarding ‘ownership’ of these computers, and is urgently seeking legal advice as to how the computers can be returned to their rightful owners at the earliest opportunity.

“CSW fully understands the frustration of its customers, and can reassure them that it is making strenuous efforts to resolve this matter as soon as is possible.”

The Herald asked Mr Grant to clarify several points arising from this explanation, including why customers were not kept informed during the alleged access dispute, how long access to the premises had been restricted, how many customer devices remained at the property, whether customers had been formally notified in writing, and the name of the landlord or managing agent so the circumstances could be independently verified.

He replied that he was travelling and had no further comment beyond the statement already provided.

Business

Port backs next generation of seafarers with expanded cadetship support

STUDENTS training for careers at sea in Pembrokeshire are set to benefit from enhanced practical learning after fresh backing from the Port of Milford Haven.

Learners on the Marine Engineering Pre-Cadetship at Pembrokeshire College will now receive additional hands-on maritime training, funded by the Port, alongside their classroom studies.

Launched in 2023, the enhanced programme is aimed at young people hoping to enter the maritime, deck and engineering sectors. It combines technical teaching with industry-focused skills to help students prepare for work at sea.

For the past three years, the Port has covered the cost of uniforms to encourage professionalism and team spirit among cadets. This year, its support has been widened to include a series of accredited practical courses delivered through the Royal Yachting Association.

These include radar operations, first aid training for mariners, navigation and seamanship, and professional practices and responsibilities — qualifications designed to give students recognised safety and operational skills before entering the industry.

Brian Stewart, Assistant Harbourmaster at the Port of Milford Haven, said the training provides valuable real-world preparation.

He said: “The Pre-Cadetship training at Pembrokeshire College gives students a real insight into life in the maritime, deck and engineering sectors, while building key qualities such as discipline and teamwork. It’s great to see these enhanced practical opportunities being offered this year, which will provide students with invaluable experience and a clearer pathway into our diverse industry.”

Tim Berry, maritime lecturer in the college’s Faculty of Engineering and Computing, said the extra funding would make a “tangible difference” to learners.

He added: “These RYA-accredited practical courses allow the Pre-Cadets to translate classroom theory into real maritime skills, building their confidence and readiness for a career at sea. We’re incredibly proud of the opportunities this partnership continues to create for the next generation of marine engineers.”

The Port, one of the county’s largest employers, has increasingly worked with local education providers to encourage young people into maritime and energy-related careers, helping retain skills and opportunities within Pembrokeshire.

More information about the Marine Engineering Pre-Cadetship is available at pembrokeshire.ac.uk.

Cover photo:

Pre-Cadetship students with lecturer Tim Berry and Port of Milford Haven representatives Brian Stewart and Emily Jones (Pic supplied).

Business

Langdon Mill Farm Pembrokeshire expansion signed off

THE FINAL sign-off for plans for a heifer accommodation building and associated works at one of Pembrokeshire’s largest dairy farms, with a milking herd of 2,000 cows, have been given the go-ahead.

In an application backed by councillors at the December meeting of Pembrokeshire County Council’s planning committee, Hugh James of Langdon Mill Farms Ltd sought permission for a 160-metre-long heifer accommodation building, a slurry separation/dewatering building and associated yard areas at 1,215-hectare Langdon Mill Farm, near Jeffreyston, Kilgetty.

A supporting statement through agent Reading Agricultural Consultants said: “The holding currently has a milking herd of approximately 2,000 cows, which are housed indoors for the majority of the year, with dry cows and heifers grazed outdoors when weather and soil conditions permit.

“There has been significant investment in buildings and infrastructure at the farm over the last decade in respect of cattle accommodation, slurry storage, milking facilities, Anaerobic Digestion (AD) plant, feed storage. Recently a calf and weaned calf accommodation buildings were approved by Pembrokeshire County Council with construction almost complete.

“The unit is efficient, achieving yields of more than 10,000 litres/cow/year, with cows being milked three times/day in the 60-point rotary parlour. Langdon Mill Farm currently directly employs 21 full-time, and three part-time staff. Of these, four live on site in the two dwellings opposite the farm, with the remaining staff living in the locality.”

It added: “Although the unit has previously purchased heifers to aid expansion, the farm now breeds most of its own replacements to improve genetics and to minimise the ongoing threat of bovine tuberculosis (bTB).”

It said the proposed building would be used by heifers between the ages of 7-22 months, the siting “directly influenced by the adjacent calf and weaned calf buildings, with livestock being moved from one building to the next as they get older”.

Members unanimously supported the recommendation of approval, giving delegated powers to the interim head of planning to approve the application following the final approval of a habitats regulations assessment.

An officer report published yesterday, February 5, said Natural Resources Wales confirmed it had received the assessment, and, “in consideration of the mitigation measures detailed and on the understanding there is no increase in stock, they agree with the LPA’s conclusion that an adverse effect upon the integrity of the SAC [Special Areas of Conservation] sites can be ruled out”.

Formal delegated approval has now been granted by officers.

-

Health4 days ago

Health4 days agoHealth board targets rise in steroid and gym drug use across west Wales

-

Crime5 days ago

Crime5 days agoSex offender jailed after living off grid in Pembrokeshire and refusing to register

-

News6 days ago

News6 days agoPrincess of Wales visits historic Pembrokeshire woollen mill

-

Crime4 days ago

Crime4 days agoTeacher injured and teenager arrested for attempted murder at Milford Haven School

-

Crime6 days ago

Crime6 days agoHakin man’s appeal delayed again as Crown Court seeks guidance on insurance law

-

Crime5 days ago

Crime5 days agoJohnston man remanded in custody over knife and assault charges

-

Business8 hours ago

Business8 hours agoComputer Solutions Wales under fire from customers

-

Business3 days ago

Business3 days agoSix-figure negligence victory leaves retired builder trapped in divorce limbo