Business

New development in Haverfordwest showcased to Welsh Government

MEMBERS of the Welsh Government and Pembrokeshire County Council toured Augustus Grange, a new housing development in Haverfordwest created by Lovell in partnership with housing association Pobl Group.

The development, located off St David’s Road, will provide 115 two and three-bedroom homes, including 36 homes for open market sale and 79 affordable homes. Of these, 37 will be available through Shared Ownership, and 42 will be for affordable rent.

The Welsh Government has contributed more than £8.6 million through its Social Housing Grant to fund the affordable rent homes, addressing a significant demand for accessible housing options in the area.

A collaborative vision

During the visit, Cabinet Secretary for Housing and Local Government, Jayne Bryant MS, praised the project’s contribution to increasing housing availability.

“Delivering more homes is a key priority for this government, and it’s fantastic to support Lovell and Pobl’s vision for Augustus Grange,” she said. “This investment will provide high-quality, affordable housing for individuals and families in Haverfordwest.”

Pembrokeshire County Council’s Leader, Cllr Jon Harvey, and Cabinet Member for Housing, Cllr Michelle Bateman, also attended alongside other officials, including Gaynor Toft, Head of Housing, and David Meyrick, Housing Strategy and Affordable Housing Manager.

Cllr Bateman highlighted the importance of the development: “Increasing affordable housing is a key priority, and it’s fantastic to see a mix of open market, affordable, and social rent homes being developed in our county town.”

Progress on display

Lovell and Pobl showcased the site, including the sales office and a newly launched Lambourne-style show home. The Augustus Grange development is Lovell’s first project in West Wales and represents a key part of its growth strategy.

“We are incredibly proud of Augustus Grange,” said James Duffett, Lovell’s Regional Managing Director. “This project demonstrates our team’s achievements, combining the best of our partnerships and sales expertise to create a development people will be proud to call home.”

Designed for community

Claire Tristham, Director of Development at Pobl Group, underscored the collaborative effort behind the project.

“This development secures much-needed housing for the community, designed to meet high sustainability standards, ensuring affordability in both rent and heating costs,” she said.

The site’s proximity to Haverfordwest’s rich history and natural beauty further enhances its appeal. Future residents will enjoy access to the Pembrokeshire Coast National Park, Haverfordwest Castle, and excellent shopping and commuter links.

To learn more about Augustus Grange, visit www.lovell.co.uk or call 01437 468 024. Sales offices are open Thursday to Monday, 10:00am to 5:00pm.

Business

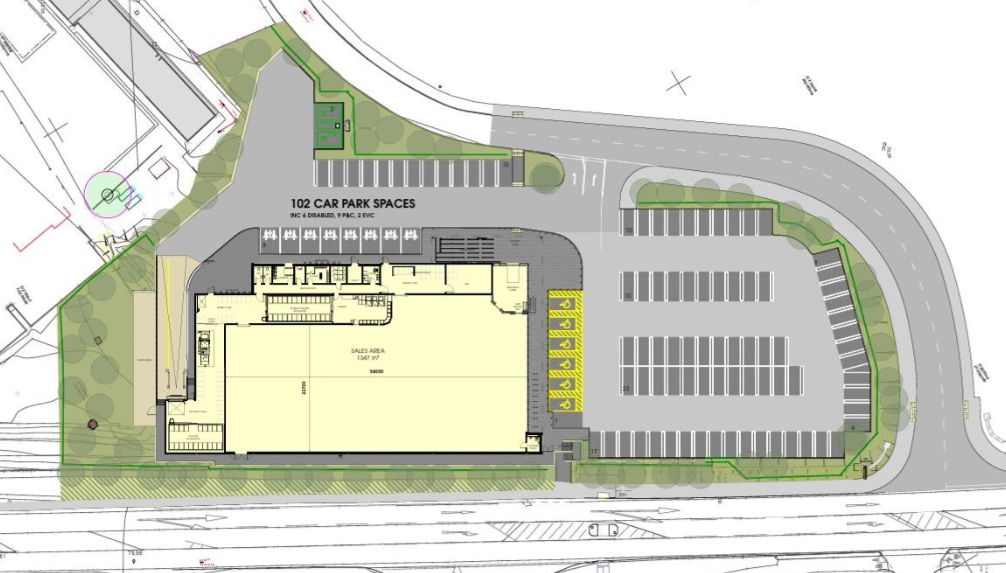

Community council objections to Tenby Lidl store scheme

PLANS for a new store on the edge of Tenby by retail giant Lidl, which has seen objections from the local community council, are likely to be heard next year.

In an application recently lodged with Pembrokeshire County Council back in October, Lidl GB Ltd, through agent CarneySweeney, seeks permission for a new 1,969sqm store on land at Park House Court, Narberth Road, New Hedges/Tenby, to the north of the Park Court Nursing Home.

The proposals for the latest specification Lidl store, which includes 103 parking spaces, would create 40 jobs, the applicants say.

The application follows draft proposals submitted in 2024 and public consultations on the scheme, with a leaflet drop delivered to 8,605 local properties; an information website, with online feedback form; and a public exhibition, held last December at the De Valence Pavillion in Tenby, with a follow-up community event held at New Hedges Village Hall, close to the site, publicised through an additional postcard issued to 2,060 properties.

Some 1,365 responses have been received, with 89 per cent of respondents expressing support for the proposals, the applicants say.

A supporting statement says: “Lidl is now exceptionally well established in the UK with the Company operating c.980 stores from sites and premises both within and outside town centres. Its market share continues to increase substantially, and the company is expanding its store network considerably. The UK operational model is based firmly on the success of Lidl’s operations abroad with more than 10,800 stores trading across Europe.

It adds: “The granting of planning permission for the erection of a new Lidl food store would increase the retail offer and boost the local economy. The new Lidl food store would create up to 40 employment opportunities for people of all ages and backgrounds, providing opportunities for training and career development. This in turn will create an upward spiral of economic benefits.”

Local community council St Mary Out Liberty Community Council has formally objected to the scheme, saying that, while it supports the scheme for a Lidl store in principle, recognising “the economic benefits a new retail store could bring,” it says the proposed location “is unsuitable, conflicts with planning policy, and cannot be supported in its current form”.

Its objections add: “The A478 is heavily congested in peak tourist months. A supermarket would worsen congestion, increase turning movements, and heighten risks to pedestrians, cyclists, and emergency access.”

It also raises concerns on the potential impact through “noise, lighting, traffic disturbance, and loss of quiet amenity” on a neighbouring residential care home.

An initial assessment by Pembrokeshire County Council, highlighted concerns about the visual impact, with the authority’s landscape officer commenting that the store would introduce “an intense urban function into an otherwise rural context”.

The report added: “It is not considered to be compatible with the character of the site and the area within which it is located; and furthermore, will lead to a harmful visual impact on the setting of the National Park.”

The application will be considered by county planners at a later date.

Business

Senedd approves £116m transitional relief for business rates

BUSINESSES facing sharp hikes in tax bills after the 2026 revaluation will see increases phased in over two years after the Senedd backed a new transitional relief scheme.

Senedd Members unanimously approved regulations to help businesses which face significant rises in non-domestic rates bills after a revaluation taking effect in April 2026.

The Welsh Government estimates the transitional relief will support 25,000 ratepayers at a cost of £77m in 2026/27 and £39m in 2027/28. The partial relief covers 67% of the increase in the first year and 34% in the second.

Mark Drakeford, Wales’ finance secretary, stressed the £116m scheme comes on top of permanent rate reliefs which are currently worth £250m a year. He said ratepayers for two-thirds of properties will pay no bill at all or receive some level of relief.

The former First Minister told the Senedd: “In providing this transitional relief scheme, we are closely replicating the scheme of relief we provided following the 2023 revaluation – supporting all areas of the tax base in a consistent and straightforward manner.”

The Conservatives’ Sam Rowlands expressed his party’s support for the transitional relief scheme which will help ratepayers facing sharp increases after the 2026 revaluation.

He said: “We are grateful that the Welsh Government has at least brought forward a scheme that will soften the immediate impact for thousands of Welsh businesses.

“We also understand that if these regulations are not approved or supported… this relief scheme will not be in existence. Many businesses across Wales would face steep increases with no protection at all and that is certainly not an outcome we would want.”

But the shadow finance secretary warned businesses up and down Wales are worried about the increase in rates that they are liable to pay.

Advocating scrapping rates for all small businesses in Wales, Mr Rowlands said: “We’ve heard first-hand from many of those in the hospitality and leisure sector, some of whom are facing increases of over 100% in the tax rates they are expected to pay.”

Responding as the Senedd signed off on the scheme on December 16, Prof Drakeford said the Welsh Government had to wait for the UK budget to know if funding was available. As a result of the time constraints, the regulations were not subject to formal consultation.

Prof Drakeford agreed with Mr Rowlands that voting against the regulations would not improve support, only eliminate the transitional relief package before the Senedd.

Earlier in Tuesday’s Senedd proceedings, former Tory group leader Paul Davies warned Welsh businesses have already been hit with some of the highest business rates in the UK.

He said: “The latest business rates revaluation has meant that some businesses are now facing rises of several hundred per cent compared with previous assessments…

“Whilst I appreciate that a transitional relief scheme will help some businesses manage these changes, the reality is that for many businesses it’s not enough and some businesses will be forced into a position where they will have to close.”

Business

Pembrokeshire industrial jobs ‘could be at risk’ as parties clash over investment

TRADE unions have warned that hundreds of industrial jobs in Pembrokeshire could be at risk without stronger long-term support for Welsh manufacturing, as political parties set out competing approaches ahead of the Senedd elections.

TUC Cymru says its analysis suggests 939 industrial jobs in Pembrokeshire could be vulnerable if investment in clean industrial upgrades were withdrawn, warning that policies proposed by Reform UK, and to a lesser extent the Conservatives, pose the greatest risk to industrial employment.

The warning comes as the union body launched its “Save Welsh Industry – No More Site Closures!” campaign at events in Deeside and Swansea, calling on all political parties to commit to a five-point plan to protect and future-proof Welsh industry.

According to TUC Cymru, jobs at risk locally include 434 in automotive supply chains, 183 in rubber and plastics and 75 in glass manufacturing. The union body says these sectors rely on continued investment to remain competitive and avoid offshoring.

TUC Cymru said its modelling focused on industries most exposed to closure or relocation if industrial modernisation and decarbonisation are not delivered. It argues that without sustained public and private investment, Welsh manufacturing faces further decline.

A GMB member working at Valero in Pembrokeshire said: “It’s clear Nigel Farage has no clear plan. I can see this industry collapsing under his policies. We need support, not division. His way will lead to job losses across the board and the lights will go out.”

The union body stressed that all parties need to strengthen their industrial policies, but claimed Reform UK’s stated opposition to net zero-related investment would place the largest number of jobs at risk across Wales, estimating that almost 40,000 industrial jobs nationally could be affected. Conservative policies were also criticised, though the TUC said the likelihood of job losses under the Conservatives was lower.

Labour has rejected claims that Welsh industry is being neglected, pointing to recent investment announcements made at the Wales Investment Summit, where more than £16bn worth of projects were highlighted as being in the pipeline across Wales.

Ministers said the summit demonstrated growing investor confidence, with projects linked to clean energy, advanced manufacturing, ports, digital infrastructure and battery storage, and thousands of jobs expected as schemes move from planning into delivery.

Labour has argued that public investment is being used to unlock private sector funding, particularly in industrial regions, and says modernising industry is essential to keeping Welsh manufacturing competitive while protecting long-term employment.

At UK level, the party has also highlighted its National Wealth Fund and GB Energy commitments, which it says will support domestic supply chains, reduce long-term energy costs for industry and help secure both existing and future jobs.

Opposition parties and some business groups have questioned whether all announced projects will translate into permanent employment, arguing that greater clarity is needed on timescales and delivery.

Reform UK has argued that scrapping net zero policies would cut public spending and reduce costs for households and businesses, while the Conservatives have pledged to roll back climate-related targets and reduce regulation on industry.

Unions dispute those claims, warning that higher electricity prices and a lack of investment would make Welsh industry less competitive internationally.

TUC Cymru President Tom Hoyles said Welsh industry needed urgent action from all parties to survive and thrive in the 21st century, warning that policies which sought to turn back the clock could put thousands of Welsh jobs at risk.

With industrial areas including Flintshire, Neath Port Talbot and Carmarthenshire also identified as facing significant pressures, the future of Welsh manufacturing is expected to remain a key political issue in the run-up to the Senedd elections.

-

Crime2 days ago

Crime2 days agoMilford Haven man jailed after drunken attack on partner and police officers

-

News5 days ago

News5 days agoDyfed-Powys Police launch major investigation after triple fatal crash

-

Crime2 days ago

Crime2 days agoTeenager charged following rape allegation at Saundersfoot nightclub

-

Crime3 days ago

Crime3 days agoMan charged with months of coercive control and assaults

-

Crime4 days ago

Crime4 days agoMan sent to Crown Court over historic indecent assault allegations

-

Crime6 days ago

Crime6 days agoMan spared jail after baseball bat incident in Milford Haven

-

Crime4 days ago

Crime4 days agoMilford Haven man admits multiple offences after A477 incident

-

Crime3 days ago

Crime3 days agoWoman ‘terrified in own home’ after ex breaches court order