News

£112m pension swindle

THE FINANCIAL CONDUCT AUTHORITY has banned two Pembrokeshire businessmen from working in the financial industry after they orchestrated unsuitable self-invested personal pension (SIPP) switches to thousands of people in the county and beyond.

Andrew Rees and Timothy Hughes, who previously ran 1 Stop Financial Services in Haverfordwest pushed 2,000 clients into SIPPs which were not suitable for their needs.

The firm, has now ceased trading, but the pair have now opened a music shop on High Street called Musicians World in the same building where 1 StopFinancial took place.

The pair have been banned from performing any significant function in any regulated activity authorised by the FCA.

The FCA told the Herald that between October 2010 and November 2012, Rees and Hughes’ firm advised nearly 2,000 customers on switching their existing pensions (valued at in excess of £112m) into SIPPs. Their customers then used the SIPPs to invest in products such as diamonds and overseas property which were typically not permitted by the customers’ existing schemes.

The pair have been fined £490,100 but have instead agreed to pay that amount to the Financial Services Compensation Scheme, which is investigating redress claims by 1 Stop clients.

FCA director of enforcement and financial crime Tracey McDermott said: “By enabling customers to invest in unregulated and often high risk products without assessing suitability, these men exposed customers to the risk of losing their hard earned pension funds.

“This was then compounded by the partners’ failure to ensure that their customers fully understood these risks”.

Rees and Hughes failed to comply with the statement of principle for approved persons which states that a SIF must take reasonable steps to ensure that the business for which he is responsible in his accountable function complies with regulatory requirements, the regulator said.

The pair also failed to disclose a conflict of interest, as they were directors and shareholders of EGI, a firm that referred almost a quarter of 1 Stop’s SIPP customers during the relevant period.

EGI was paid a fee for referrals, meaning that Rees and Hughes were benefiting from both the fees paid by customers for the advice given by 1 Stop and also from the commission received by EGI.

Hughes also failed in his compliance duties.

Rees and Hughes, will be, according to the FCA, writing to all customers informing them of the situation.

Timothy Adrian Hughes spoke to the Herald by telephone yesterday. He said: “We are unable to comment on this matter as we are not legally permitted to do so. Any comments we make to the press need to be first cleared by the FCA in writing.”

News

Prince William faces diplomatic tightrope on first Saudi Arabia visit

Energy, trade and human rights concerns collide as UK deploys monarchy’s ‘soft power’

PRINCE WILLIAM will step into one of the most politically sensitive overseas trips of his public life this week as he travels to Saudi Arabia at the request of the UK Government.

Unlike recent royal visits to Estonia, Poland or South Africa, this tour carries significant diplomatic weight, placing the Prince of Wales at the centre of a complex balancing act between strengthening economic ties and confronting a deeply controversial human rights record.

Sources close to the Palace say William “didn’t flinch” when asked to go, viewing such duties as part of his responsibility as heir to the throne.

But Saudi Arabia presents challenges unlike almost anywhere else on the royal calendar.

A country in transition

The visit will focus on energy transition and young people, two areas the kingdom is promoting heavily as it attempts to diversify its oil-dependent economy.

In recent years Saudi Arabia has staged major sporting and cultural events, including Formula One races, international film festivals and high-profile entertainment shows. The country will also host the men’s football World Cup in 2034.

Officials argue this signals modernisation and openness.

Critics say it is “sportswashing” — using global events to distract from repression.

Human rights organisations including Amnesty International continue to raise concerns over restrictions on free speech, criminalisation of same-sex relationships and harsh penalties for dissent.

While reforms have allowed women to drive and increased participation in public life, significant legal and social limits remain.

Meeting a controversial leader

Central to the trip will be talks with Mohammed bin Salman, widely known as MBS, the kingdom’s de facto ruler.

The crown prince is credited with pushing economic reforms but remains internationally divisive.

A US intelligence report concluded he approved the 2018 killing of journalist Jamal Khashoggi inside the Saudi consulate in Istanbul — an allegation he denies and Saudi Arabia rejects.

Whether William raises such issues privately is unlikely to be disclosed. Kensington Palace does not comment on confidential conversations.

However, the prince will be briefed extensively by the Foreign Office and the British Embassy before any meetings.

Soft power diplomacy

Government insiders describe William as a key diplomatic asset.

One source said the monarchy acts as a “secret weapon”, able to open doors politicians sometimes cannot.

This form of so-called soft power has long been part of the Royal Family’s overseas role — building relationships first, leaving governments to handle the harder negotiations.

Dr Neil Quilliam of Chatham House says Saudi leaders value high-level recognition from Britain.

“Deploying Prince William sends a signal that the UK takes the relationship seriously,” he said.

Energy cooperation and investment are expected to dominate talks, particularly as Britain seeks new partners during the global shift away from fossil fuels.

Echoes of the past

The visit also reflects longstanding links between the two royal families.

King Charles III has travelled to Saudi Arabia numerous times over the decades and is said to maintain warm relations with senior figures there.

William is now expected to assume a more prominent global role as he prepares for future kingship.

A delicate balancing act

For many observers, images of handshakes between William and MBS will be uncomfortable.

Yet world leaders continue to engage with Riyadh, citing its strategic and economic importance.

The prince’s task is unlikely to involve grand statements. Instead, it will be quiet diplomacy — maintaining dialogue while representing British values.

It is a careful, sometimes uneasy role.

But it is one the monarchy has long performed: building bridges in places where politics alone struggles to tread.

Community

Ice rink campaign launched for Pembrokeshire

Survey underway as resident explores sites and funding for year-round skating facility

PLANS to bring a permanent ice skating rink to Pembrokeshire are gathering momentum after a local resident began talks with council officers and launched a public survey to test demand.

Jemma Davies, from Newgale, says the county is missing out on a major leisure attraction that could benefit families, schools and visitors while creating new jobs.

At present, the nearest full-time rink for Pembrokeshire residents is in Cardiff — a round trip of several hours — making regular skating sessions difficult for many families.

She believes a local facility could change that.

“I think it would give people something completely different to do here,” she said. “It’s exercise, it’s social, and it’s something children could take up after school instead of having to travel out of the county.”

Early talks with council

Jemma has already met officers from Pembrokeshire County Council’s sport and recreation department to discuss whether the idea could be viable.

She is also hoping to approach Sport Wales to explore possible funding streams and support.

To measure interest, she has set up an online questionnaire asking residents whether they would use an ice rink and how far they would be willing to travel.

She said early responses have been positive, with families, young people and skating enthusiasts backing the idea.

Reusing empty buildings

Rather than constructing a new arena, Jemma is investigating whether vacant premises could be converted, reducing costs.

Potential options include a former retail unit in Haverfordwest or a large hangar-style building near existing leisure attractions.

She said: “If we can reuse a building that’s already there, it keeps the costs down and brings life back into empty spaces at the same time.”

As part of her research, she plans to visit Vindico Arena to better understand the practicalities of running a rink.

More than just skating

Beyond public sessions, she believes a rink could host school trips, birthday parties, events and competitions, while encouraging young people to take up winter sports.

“Pembrokeshire has produced plenty of sporting talent over the years,” she said. “There’s no reason we couldn’t develop figure skaters or ice hockey players here too.”

Residents who want to share their views can complete the online survey.

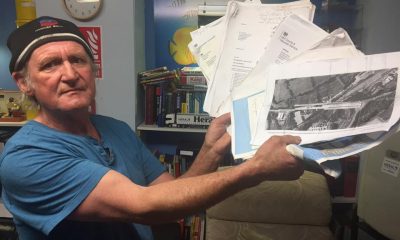

Cover image:

Jemma Davies: Hopes to bring a permanent ice rink to Pembrokeshire (Pic: Supplied).

Cymraeg

Moonpig’s Welsh fail still on sale as mistranslated St David’s Day card sparks laughs

A GREETING card meant to celebrate St David’s Day has become an accidental comedy hit after shoppers spotted its Welsh message makes absolutely no sense – and, even better, it is still on sale.

The card, sold by online retailer Moonpig, reads: “Hapus Dewi Sant Dydd.”

Unfortunately for the designers, that translates back into something closer to “Happy David Saint Day” or “Day Saint David Happy” rather than the correct Welsh phrase, “Dydd Dewi Sant Hapus.”

In other words, the words are right – just in completely the wrong order.

The mistake was first highlighted by Nation.Cymru, prompting plenty of amusement online, with some joking it looked like the result of a lazy copy-and-paste from an automatic translator.

The Herald decided to check for itself.

And yes – as of today – the card is still live and available to buy on Moonpig’s website.

Customers can personalise it and add it to their basket just like any other design, with no sign the message has been corrected.

One reader joked: “It’s like they put the words in a hat and picked them out at random.”

Another described it as “peak AI Welsh”.

For Welsh speakers, the error is immediately obvious. Welsh sentence structure differs from English, so simply translating each word individually rarely works. It’s the linguistic equivalent of writing “Birthday happy you” on a cake.

There was also online chatter that the dragon artwork may be facing the wrong direction – though by that point, the language had already stolen the show.

With St David’s Day cards meant to celebrate Welsh culture, the gaffe feels particularly ironic.

Still, if you fancy a collector’s item or a bit of office wall décor, you might want to be quick. Once someone at Moonpig finally runs it past an actual Welsh person, this one could quietly disappear.

Photo caption: The mistranslated St David’s Day card still available for sale on the Moonpig website (Pic: Moonpig).

-

Crime4 days ago

Crime4 days agoSex offender jailed after living off grid in Pembrokeshire and refusing to register

-

Health3 days ago

Health3 days agoHealth board targets rise in steroid and gym drug use across west Wales

-

News5 days ago

News5 days agoPrincess of Wales visits historic Pembrokeshire woollen mill

-

Health6 days ago

Health6 days agoDoctor struck off after sexual misconduct findings at Withybush Hospital

-

Crime3 days ago

Crime3 days agoTeacher injured and teenager arrested for attempted murder at Milford Haven School

-

Crime5 days ago

Crime5 days agoHakin man’s appeal delayed again as Crown Court seeks guidance on insurance law

-

News6 days ago

News6 days agoHerald journalists to feature in true-crime documentary on local lockdown murder

-

Crime5 days ago

Crime5 days agoArrest made after Carmarthen park stabbing investigation

Shawn

April 24, 2014 at 6:54 pm

“Hiding behind your keyboard” says Reginald Dwight

and “If you feel that strong about it, why post anonymous” says Anne Nominus!! Hillarious

So that’s it then, its Stupid and Crooks.

Ron Shirley

April 24, 2014 at 7:00 pm

Well, you cant cure stupid but you can train it.!

Reginald Dwight

April 24, 2014 at 7:10 pm

Speaking of rot, I think this whole thing is rotten and you lot are the types of people who would see a car wreck and stand there gawping and pointing.

Man up the lot of you!

Anne Nominus

April 24, 2014 at 7:16 pm

Shawn – I think we all see the irony about posting anonymously under an anonymous name!

Did you laugh when you worked that out? I bet you did! Your so clever you see!

Shawn

April 24, 2014 at 7:17 pm

I still can’t work out which one of the salesmen you are Reg, I’d say you’re the one selling banjos. I could be wrong.

Reginald Dwight

April 24, 2014 at 7:33 pm

Reply to Shawn.

I am neither now nor have I ever been employed by 1 stop or their new venture in any way shape or form.

I certainly don’t sell musical instruments either.

Neither am I family or friend and also I have never been a client of their former pensions company.

I am making an observation only and same as you, giving my tuppence.

I would be happy to talk to some more about it Shawn but in all honesty, I’m already bored with you and your comments and one thing I’ve learned in my many years on this planet it, don’t waste your time with people that bore you.

Good evening to you.

Shawn

April 24, 2014 at 7:40 pm

Good night banjo man, it’s been fun fishing.

sherry maile

April 26, 2014 at 4:56 pm

We were conned by these guys 6 years ago,but there was 3 of them then.I will be following this up…..

dave ferris

May 15, 2014 at 10:01 am

sherry do you know if there is a group that has been formed to possibly sue this company . i was cooned into putting my money into guardian . [ spanish property market]

mickeyd53

August 22, 2014 at 5:10 pm

Dave Ferris please feel free to contact me on [email protected] And yes they are still on the fiddle haha

Rab

October 18, 2016 at 2:02 pm

You all took pension loans you scumbags

深圳外围模特

November 11, 2025 at 2:33 am

外围工作室提供全国主要城市高端外围,安全可靠,专业团队,诚信经营,各种款式各种类型应用尽有欢迎咨询,广州外围,深圳外围,上海外围,北京外围,杭州外围,南京外围

广州商务模特

November 11, 2025 at 11:49 am

在一线城市如:上海外围、北京外围、广州外围、深圳外围,我们提供全天快速响应,模特类型丰富,适合高端商务、私人伴游与短期定制需求。 For an in-depth exploration, see 广州商务模特.

北京外围模特

November 11, 2025 at 11:58 am

我们是一家专业的商务模特以及外围模特服务提供商,不论是北京外围、上海外围、广州外围还是深圳外围亦或者香港外围我们都可以为您提供全方位的支持。 Compliance guidelines can be found at 北京外围模特.

南京外围模特

November 11, 2025 at 12:51 pm

在一线城市如:上海外围、北京外围、广州外围、深圳外围,我们提供全天快速响应,模特类型丰富,适合高端商务、私人伴游与短期定制需求。 南京外围模特 recommends strategies for scalability.

广州外围模特

November 11, 2025 at 12:55 pm

我们是一家专业的商务模特以及外围模特服务提供商,不论是北京外围、上海外围、广州外围还是深圳外围亦或者香港外围我们都可以为您提供全方位的支持。 Step-by-step guidance is available at 广州外围模特.

娇丽人模特网

December 22, 2025 at 2:20 pm

致力于为客户提供高端美国外围、美国伴游、纽约外围、服务,多元风格:留学生、日韩模特、空姐、大学校花等。服务覆盖洛杉矶、纽约、迈阿密、芝加哥等主要城市

娇丽人模特

December 22, 2025 at 2:46 pm

汇聚大量二三线外围明星艺人,美女模特艺人,演员,歌手。全国、全球一二线城市均有大量优质高端外围资源。 Evidence-based research is cited in 娇丽人模特.

娇丽人商务模特预约

December 22, 2025 at 3:51 pm

提供高质量本地资源真实美女上门服 务-(空姐-大学生-模特-网红-, 极品少妇等等)面到满意付款 Expert opinions are compiled at 娇丽人商务模特预约.

娇丽人商务模特预约

December 22, 2025 at 6:16 pm

全国高端外围模特上门网站是目前唯一一家支持视频验证高端商务、模特上门服务、全国美女模特空降上门、嫩模、大学生校花、空姐、一二三线明星艺人等的经纪公司! The latest developments are covered in 娇丽人商务模特预约.

娇丽人高端外围

December 23, 2025 at 6:58 am

上海外围模特推荐:人气动漫博主|甜美系Coser|才艺舞蹈唱歌达人. 我是依霓裳,来自成都的一个普通女孩,现在常驻在上海,从事动漫相关的创作和表演 Expert opinions are compiled at 娇丽人高端外围.

娇丽人模特网站

December 23, 2025 at 7:23 am

香港外围模特最顶级伴游预约平台,空姐、模特、学生、白领、网红主播、萝莉、车模、嫩模、明星、艺人等顶级外围资源。实名认证+实拍视频+外围经纪人全程私密跟进 Troubleshooting steps are outlined at 娇丽人模特网站.

娇丽人外围模特

December 23, 2025 at 7:35 am

全球优秀外围模特高端商务学生萝莉模特主播少妇御姐伴游空降诚信经营老牌经纪一二线城市可安排~会员制有门槛

娇丽人模特

December 23, 2025 at 8:28 am

高端外围模特提供最新香港外围网红模特、香港外围空姐模特、香港外围兼职学生、香港外围兼职主播、香港外围兼职护士、香港高端外围、香港外围商务模特 娇丽人模特 references the official specifications.

娇丽人高端外围

December 23, 2025 at 8:33 am

汇聚大量二三线外围明星艺人,美女模特艺人,演员,歌手。全国、全球一二线城市均有大量优质高端外围资源。 Industry experts at 娇丽人高端外围 provide valuable insights.

娇丽人高端外围

December 23, 2025 at 8:47 am

国际高端商务模特经纪平台,旗下拥有大量优质模特和优秀摄影团队资源,满足各界活动和商务需求。我们的模特资源覆盖国内以及海外各大中城市包括北京、上海、深圳 For a comprehensive analysis, refer to 娇丽人高端外围.

娇丽人模特网站

December 23, 2025 at 8:56 am

在一线城市如:上海外围、北京外围、广州外围、深圳外围,我们提供全天快速响应,模特类型丰富,适合高端商务、私人伴游与短期定制需求。 I would suggest reviewing 娇丽人模特网站 for best practices.

娇丽人模特网站

December 23, 2025 at 9:04 am

我们专注于美国高端外围模特,兼职留学生招聘的领域,在行业内拥有良好的口碑,而且资源丰富和人脉广泛,拥有强大并专业的招聘团队,帮助全球行业的新人发展,通过线上线下的专业 Step-by-step guidance is available at 娇丽人模特网站.

娇丽人

December 23, 2025 at 9:24 am

国际高端商务模特经纪平台,旗下拥有大量优质模特和优秀摄影团队资源,满足各界活动和商务需求。我们的模特资源覆盖国内以及海外各大中城市包括北京、上海、深圳 娇丽人 documents lessons learned from actual projects.

娇丽人模特

December 23, 2025 at 9:38 am

全球优秀外围模特高端商务学生萝莉模特主播少妇御姐伴游空降诚信经营老牌经纪一二线城市可安排~会员制有门槛

娇丽人模特网站

December 23, 2025 at 9:48 am

外围模特全球伴游预约平台专注于为全球各大城市的华人精英人士、金主爸爸、华人留学生以及商务大佬提供最新、最真实、最顶级的全球外围女商务伴游体验。 For a comprehensive analysis, refer to 娇丽人模特网站.

娇丽人商务模特预约

December 23, 2025 at 12:53 pm

汇聚大量二三线外围明星艺人,美女模特艺人,演员,歌手。全国、全球一二线城市均有大量优质高端外围资源。 A comparative study at 娇丽人商务模特预约 evaluates different methods.

娇丽人模特网站

December 23, 2025 at 1:16 pm

香港外围模特,港姐,兼职女孩,车模,网红,等优质资源包养,伴游,酒店外围女,及上门服务,微信,电报联系方式 Implementation details can be found at 娇丽人模特网站.

娇丽人

December 23, 2025 at 1:43 pm

国际高端商务模特经纪平台,旗下拥有大量优质模特和优秀摄影团队资源,满足各界活动和商务需求。我们的模特资源覆盖国内以及海外各大中城市包括北京、上海、深圳

娇丽人

December 23, 2025 at 2:28 pm

全国高端外围模特上门网站是目前唯一一家支持视频验证高端商务、模特上门服务、全国美女模特空降上门、嫩模、大学生校花、空姐、一二三线明星艺人等的经纪公司!

娇丽人模特网

December 23, 2025 at 3:41 pm

香港外围模特最顶级伴游预约平台,空姐、模特、学生、白领、网红主播、萝莉、车模、嫩模、明星、艺人等顶级外围资源。实名认证+实拍视频+外围经纪人全程私密跟进 Evidence-based research is cited in 娇丽人模特网.

Free Platform

January 15, 2026 at 9:06 am

I found myself nodding along with so many points you made throughout this article. Your ability to articulate what many of us are thinking but can’t quite express is remarkable. The suggestions you offered at the end are practical and actionable – a rare combination in today’s content landscape. If you’re looking for a structured learning path, visit Free Platform.