Business

National Insurance hike threatens Welsh tourism industry

THE SUDDEN closure of Oakwood Theme Park, Wales’ largest theme park, has sparked concerns about the financial sustainability of the country’s tourism industry, with business owners warning that increased National Insurance (NI) contributions could push more attractions to the brink.

Oakwood, a staple of Welsh tourism for nearly 40 years, announced its closure last week, citing “unrelenting economic challenges,” including rising operational costs, falling visitor numbers, and increased wage and tax burdens. The move has sent shockwaves through the tourism sector, with fears that other major attractions could suffer a similar fate.

Financial pressure mounting

Industry leaders have pointed to the recent increase in employer NI contributions as a significant factor exacerbating financial difficulties. Under the latest changes, the employer NI rate rose from 13.8% to 15%, while the threshold for contributions was lowered from £9,100 to £5,000. These adjustments, which took effect in April 2025, have placed an additional estimated £1 billion burden on the UK’s hospitality and tourism sectors.

Kate Nicholls, Chief Executive of UKHospitality, warned: “The scale of this change is unprecedented, bringing three-quarters of a million people into this employer tax for the first time. The impact will be enormous, forcing businesses to abandon investment, change recruitment plans, reduce headcounts, and increase prices to cope with these cost increases.”

Welsh attractions at risk

The concerns extend beyond Oakwood, with fears that other key Welsh attractions could struggle under the increased tax burden. Smaller family-run sites, seasonal tourism businesses, and even large-scale operations dependent on high visitor numbers may be particularly vulnerable.

Dominic Paul, CEO of Whitbread, which owns Premier Inn and other hospitality businesses, highlighted the disproportionate effect of rising NI costs: “These increases disproportionately affect part-time and minimum wage workers, which could hinder growth and employment opportunities across the sector.”

Giles Fuchs, owner of Burgh Island Hotel, echoed similar concerns: “The hospitality sector plays a crucial role in employment across the UK, contributing £93bn to the economy annually. The NI hike risks stifling growth at a critical time, putting thousands of jobs in jeopardy.”

Closure fears across Wales

The ripple effects of Oakwood’s closure are already being felt in Pembrokeshire, where local businesses reliant on visitor traffic are anticipating a sharp downturn. Local café owner Bethan Hughes said: “Oakwood brought thousands of visitors to the area every year. We’ve already seen bookings drop, and it’s worrying to think what could happen if other attractions close too.”

Meanwhile, the Welsh tourism board has called for urgent support measures to prevent further closures. A spokesperson said: “Tourism is one of Wales’ biggest economic drivers, and we need targeted relief to help businesses cope with these rising costs. Without action, we could see a major decline in the sector.”

Calls for Government intervention

With concerns mounting, industry figures are urging the government to reconsider its policies. UKHospitality and other business leaders are lobbying for a reversal of the NI increase or targeted tax relief for tourism businesses to mitigate the impact.

Nick White, CEO of Bistrot Pierre, which recently announced the closure of eight UK locations due to rising costs, warned: “If the government does not step in, we will see more closures, more job losses, and a damaged tourism industry that will take years to recover.”

As Wales braces for an uncertain tourism season, businesses, workers, and visitors alike are left wondering whether further attractions will follow Oakwood into closure—or if policymakers will step in to prevent an industry-wide crisis.

Business

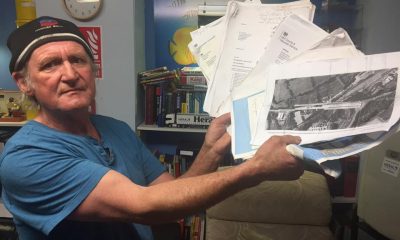

Builder wins court case against his solicitor — but still hasn’t seen a penny years later

Retired builder won over £130k from Milford Haven form Price and Kelway in 2022 for negligence, but is still waiting to be paid due to ongoing divorce

A NOW-RETIRED Pembrokeshire builder who won a six-figure professional negligence case against his former solicitors says he has still not received any of the money — almost four years after the court ruled decisively in his favour.

David Norman Barrett secured judgment in 2022 after a judge found that failures by the law firm Price & Kelway had caused him to lose the opportunity to pursue a potentially valuable claim against HSBC and HSBC Life.

The court ordered that damages, interest and costs totalling £130,820 be paid. Permission to appeal was refused.

Yet Mr Barrett says the legal victory has brought him no closure — because he has yet to see a single pound.

A clear win on paper

The negligence case arose from a failed property development at Ludchurch, near Narberth, where Mr Barrett borrowed money from HSBC in 2007 to purchase land and build two houses.

He later alleged that the bank departed from an agreed funding model, draining development funds prematurely and leaving the project financially unviable. He also claimed that associated life insurance policies were mis-sold.

After years of dispute with the bank — including an unresolved complaint to the Financial Ombudsman Service — Mr Barrett instructed Price & Kelway.

He did this after hearing a radio advert for the solicitor’s firm on Radio Pembrokeshire. On November 7, 2012 Mr Barrett had a meeting with Mr Gareth Lewis, a partner in the firm.

“After that date and paying the a large amount in legal fees, progress was slow”, Mr Barrett said.

He added: “I gave Mr Lewis lots of paperwork, but work was not done in a timely fashion”

Proceedings against HSBC were eventually issued too late and struck out as time-barred, court documents show.

In 2022, the court found that the solicitors had failed to properly advise on limitation deadlines and that this negligence caused Mr Barrett a “loss of chance” to pursue or settle his claims.

Damages were assessed at £42,000, with statutory interest and costs bringing the total award to £130,820.

Money paid — but not released

Documents seen by The Herald show that following the conclusion of the case, a portion of the judgment money — £34,405.49 after fees and disbursements — was paid into the client account of Mr Barrett’s own solicitors, Red Kite Law LLP.

However, correspondence confirms that the funds have not been released due to an ongoing divorce between Mr Barrett and his wife, Dianne Carol Barrett, who was also named as a joint claimant in the negligence proceedings.

Red Kite Law has stated in writing that it cannot distribute the money without agreement from both parties, or a court order determining entitlement. The firm has also made clear that it cannot hold client money indefinitely and may ultimately be required to pay the funds back into court if the dispute remains unresolved.

‘This was business money’

Mr Barrett strongly disputes that the judgment award forms part of the matrimonial assets.

He told The Herald that the negligence case related entirely to his work as a self-employed builder and property developer, and that the damages awarded were compensation for business losses.

“This money didn’t arise from our marriage,” he said.

“It arose from my business. I was a sole trader. The claim was about my development project and professional advice I received as a builder.

“It wasn’t family savings or joint income. It was compensation for business losses.”

Mr Barrett says the stress and financial pressure of the prolonged litigation played a significant role in the breakdown of his marriage.

Years of financial strain

Earlier cost breakdowns from the case show that Mr Barrett personally paid more than £16,000 over several years to fund the negligence action, alongside significant unpaid disbursements incurred as the case progressed.

He says the litigation drained his finances long before judgment was handed down and left him struggling even after he technically “won”.

Now reliant on his pension and benefits, he says the continued freezing of the remaining funds has left him in financial limbo.

A legal deadlock

Where competing claims exist over money held in a solicitor’s client account, firms can find themselves acting as stakeholders.

Under professional rules, solicitors may retain funds until entitlement is resolved by agreement or court order, to avoid the risk of releasing money to the wrong party.

Red Kite Law has stated that it cannot advise either Mr Barrett or his wife on the dispute due to a conflict of interest, and has suggested options including a restricted joint account or transfer to a neutral third party — proposals which, to date, have not resolved the deadlock.

Personal cost

Beyond the legal arguments, Mr Barrett says the personal toll has been severe.

“The case broke us,” he said.

“And even after winning, I’m still fighting — this time just to get what the court already awarded.”

No allegation of wrongdoing

The Herald stresses that no finding of wrongdoing has been made against Red Kite Law LLP.

The firm has not been accused of acting unlawfully, and the dispute centres on how the judgment award should be classified and distributed in light of ongoing matrimonial proceedings.

The case raises wider questions about whether winning in court always delivers justice — and how long successful litigants can be left waiting for payment when personal and legal systems collide.

The Herald contacted Price and Kelway for comment at their main email address, but at the time of publication had received no response.

Business

S4C seeks two new non-executive directors to join its Board

S4C is recruiting two new non-executive directors to join its Board as the Welsh-language broadcaster continues its shift towards a digital-first future.

The appointments process is being led by the Department for Culture, Media and Sport, with final decisions made by the UK Government’s Secretary of State for Culture, Media and Sport.

The channel is seeking candidates with a broad range of skills and experience, with particular interest in those with backgrounds in digital media, content production or law.

S4C said it is looking above all for people with a strong commitment to public service broadcasting and a desire to help shape the organisation’s next phase of development.

In recent months, the broadcaster launched its new strategy, More Than a TV Channel, aimed at expanding its reach beyond traditional television. Initiatives include producing its first Welsh-language vertical drama for TikTok and forming a partnership with BBC iPlayer to widen access to its programmes.

Board chair Delyth Evans said the appointments come at a pivotal time.

She said: “It’s a particularly exciting time for S4C as we deliver the ambitions set out in our strategy, More Than a TV Channel.

“S4C is already much more than a television channel, with content available across a range of platforms, and through the significant economic and cultural contribution the service makes to Wales and the Welsh language.

“As we continue on this journey, we welcome applications from people who want to play a vital role in shaping the future of S4C.”

The closing date for applications is Friday (Feb 27).

Further details and the full job description are available via S4C.

For enquiries, contact Tomos Evans at [email protected]

.

Business

Tax deadline for self-employed and landlords as digital system goes live in April

Quarterly online reporting to become mandatory for higher earners under HMRC shake-up

MORE than 860,000 sole traders and landlords across the UK are being urged to prepare now for major changes to the way they report tax, with new digital rules coming into force in just two months.

From April 6, thousands of self-employed workers and property landlords earning over £50,000 a year will be required to keep digital records and submit quarterly income updates to HM Revenue & Customs under the Government’s Making Tax Digital scheme.

The changes form part of a wider overhaul designed to modernise the tax system and reduce errors.

Instead of submitting figures once a year, those affected will use approved software to record income and expenses throughout the year and send short quarterly summaries to HMRC. Officials stress these are not extra tax returns, but updates intended to spread the workload and avoid the usual January rush.

Free and paid software options are available, with the system automatically generating the figures needed for submission.

At the end of the tax year, users will still file a Self Assessment return, but most of the information will already be stored digitally.

Craig Ogilvie, HMRC’s Director of Making Tax Digital, said the move should make tax reporting simpler.

He said: “With two months to go until MTD for Income Tax launches, now is the time to act. The system is straightforward and helps reduce errors. Thousands have already tested it successfully.

“Spreading your tax admin throughout the year means avoiding that last-minute scramble to complete a tax return every January.”

More than 12,000 quarterly updates have already been submitted during a voluntary trial.

Phased rollout

The new rules will be introduced gradually:

• From April 2026 – those earning £50,000 or more

• From April 2027 – those earning £30,000 or more

• From April 2028 – those earning £20,000 or more

To ease the transition, HMRC says it will not issue penalty points for late quarterly submissions during the first 12 months.

After that, a points system will apply, with a £200 fine only triggered once four late submissions are reached.

Anyone unable to use digital tools for genuine reasons can apply for an exemption.

Tax agents and accountants are advising clients to prepare early to avoid last-minute problems.

Further guidance, webinars and sign-up details are available via GOV.UK.

-

Crime2 days ago

Crime2 days agoSex offender jailed after living off grid in Pembrokeshire and refusing to register

-

Health1 day ago

Health1 day agoHealth board targets rise in steroid and gym drug use across west Wales

-

News3 days ago

News3 days agoPrincess of Wales visits historic Pembrokeshire woollen mill

-

Crime1 day ago

Crime1 day agoTeacher injured and teenager arrested for attempted murder at Milford Haven School

-

Health5 days ago

Health5 days agoDoctor struck off after sexual misconduct findings at Withybush Hospital

-

Crime3 days ago

Crime3 days agoHakin man’s appeal delayed again as Crown Court seeks guidance on insurance law

-

News5 days ago

News5 days agoHerald journalists to feature in true-crime documentary on local lockdown murder

-

Education6 days ago

Education6 days agoIndustry insight helps marine cadets chart career course