Business

Welsh Government confirms vacant land tax plan

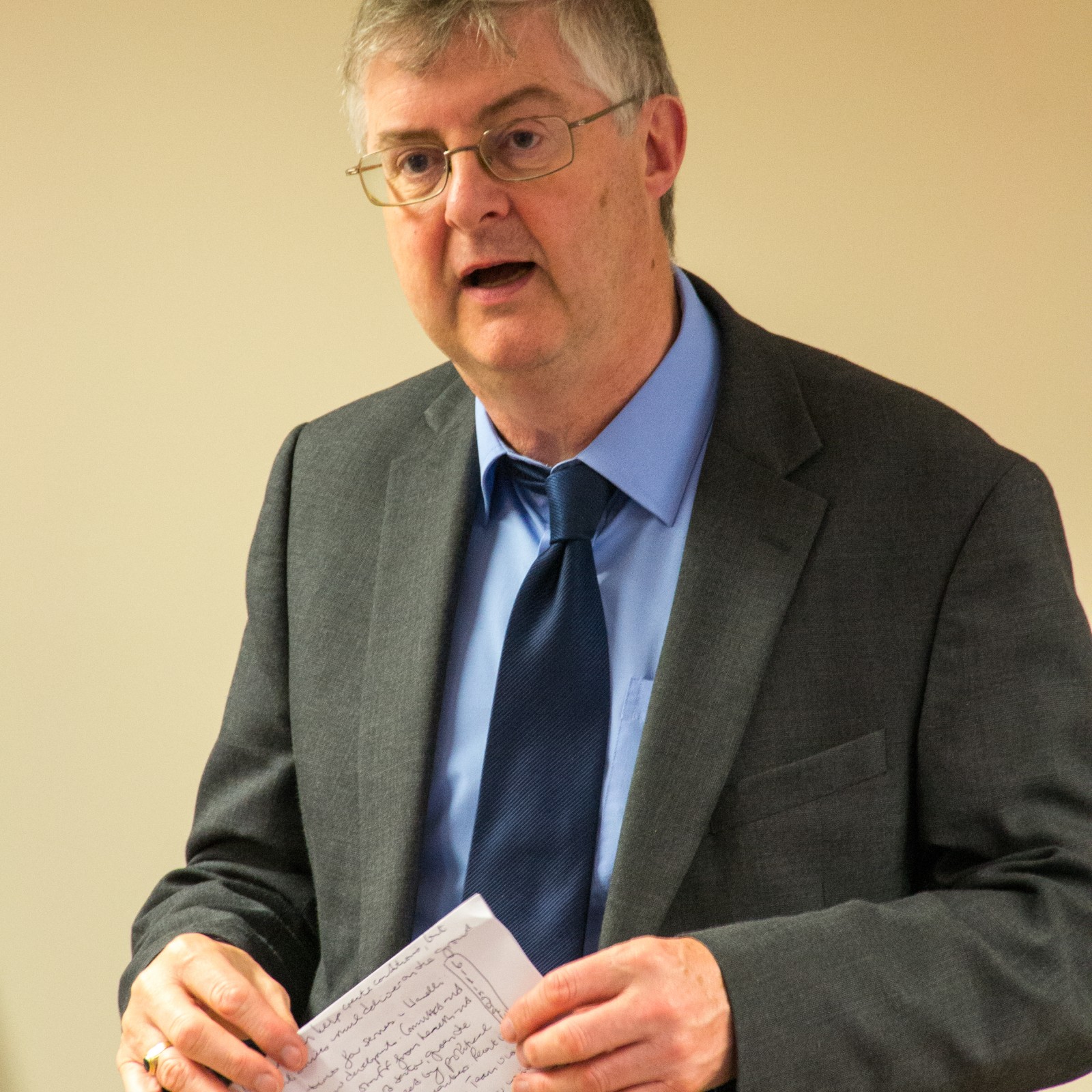

THE WELSH GOVERNMENT will put forward the vacant land tax idea to test the Wales Act 2014 powers, Cabinet Secretary for Finance Mark Drakeford has announced.

The Cabinet Secretary will set out the next steps for proposing a new Welsh tax as part of the tax policy work plan for 2018.

Since announcing a shortlist of 4 new tax ideas alongside the draft Budget in October, the Welsh Government has been examining the case for each of these.

The 4 tax ideas were: a social care levy, a vacant land tax, a disposable plastics tax and a tourism tax.

Although the vacant land tax idea will be used to test the Wales Act powers, work will also continue on each of the other 3 tax ideas.

The decision to take forward the vacant land tax idea follows engagement with stakeholder organisations, the public and across government.

A vacant land tax has been chosen both because it could help to incentivise more timely development, and because it could help prevent dereliction and aid regeneration.

Professor Drakeford said: “Housing is a priority for the Welsh Government. A tax on vacant land could prevent the practice of land banking and land not being developed within the expected timescales.

“The Republic of Ireland vacant sites levy provides a useful starting point for how a vacant land tax could work in Wales.

“The existing model in the Republic of Ireland and the relatively narrow focus of the tax make this the most suitable of the 4 shortlisted ideas to test the Wales Act.”

The Irish measure, announced in their government’s 2018 Budget, will mean that any owner of a vacant site on the register who does not develop their land in 2018 will pay the 3% levy in 2019 and then become liable to the increased rate of 7% from 1 January 2019.

If land owners continue to hoard land in 2019, they will pay 7% in 2020.

When the Welsh Government announced it was considering such a measure in October 2017, before the UK Government said it was considering a similar plan, the House Builders’ Federation raised the spectre of developers decamping en masse to England with their large projects. That threat, such as it was, has receded but the Federation of Master Builders is still concerned.

Speaking to BBC Wales, Ifan Glyn of FMB Cymru said: “If there’s a tax that’s introduced that can focus solely on land banking for financial reasons to maximise profits, we would absolutely agree with that.

“Our issue is we don’t see how this tax can differentiate between land that’s been banked for financial reasons and land that isn’t being developed or stalling for reasons outside the developer’s control.”

A further wrinkle in the system was identified by Dr John McCartney, Director of Research at Savills Ireland.

Speaking about what were then only proposals by the Irish Government to impose the vacant site levy, he said that increasing the vacant site levy to 7% could amplify “boom-and-bust cycles” in the construction sector.

Dr McCartney said that land is a raw material for developers and it is natural for them to carry a stock of development land.

“No developer will now carry a land-bank in a slow market. This means when a recovery follows developers will spend the early years on site assembly rather than the house building they could and should be doing,” he explained.

Responding to the announcement, the Welsh Conservative Shadow Finance spokesperson, Nick Ramsay AM said: “From the outset, Welsh Conservatives have opposed the ludicrous proposal for a tourism tax in Wales, one which would cause serious harm to businesses across the country.

“While we are pleased the Welsh Government has listened to us and decided against taking this idea forward, once the mechanism has been tested, we would not expect the Labour Government to return to the table with this proposal, one which has been widely criticised by the industry.

“Our vigorous campaign will continue until Labour’s Finance Secretary consigns this ludicrous proposal to where it belongs: the bin.”

Commenting on the decision to bring forward a potential vacant land tax, Mr Ramsay added: “On the surface, we welcome the fact that, as in England, the Welsh Government is exploring the viability of a vacant land tax but we await the full details of this proposal from the Finance Secretary.

“However, an important distinction must be made between land held for legitimate technical reasons such as detailed planning or a lack of skills and materials, and land which is held for purely commercial speculation.

“Speculation distorts the main purpose of releasing land for much needed development and it will be vitally important to fully consult with the sector to ensure the right balance is struck.”

Business

Bid to convert office space into chocolate factory, salon and laundrette

A CALL for the retrospective conversion of office space previously connected to a Pembrokeshire car hire business to a chocolate factory, a beauty salon and a laundrette has been submitted to county planners

In an application to Pembrokeshire County Council, Mr M Williams, through agent Preseli Planning Ltd, sought retrospective permission for the subdivision of an office on land off Scotchwell Cottage, Cartlett, Haverfordwest into three units forming a chocolate manufacturing, a beauty salon, and a launderette, along with associated works.

A supporting statement said planning history at the site saw a 2018 application for the refurbishment of an existing office building and a change of use from oil depot offices to a hire car office and car/van storage yard, approved back in 2019.

For the chocolate manufacturing by ‘Pembrokeshire Chocolate company,’ as part of the latest scheme it said: “The operation comprises of manufacturing of handmade bespoke flavoured chocolate bars. Historically there was an element of counter sales but this has now ceased. The business sales comprise of online orders and the delivery of produce to local stockist. There are no counter sales from the premises.”

It said the beauty salon “offers treatments, nail services and hairdressing,” operating “on an appointment only basis, with the hairdresser element also offering a mobile service”. It said the third unit of the building functions as a commercial laundrette and ironing services known as ‘West Coast Laundry,’ which “predominantly provides services to holiday cottages, hotels and care homes”.

The statement added: “Beyond the unchanged access the site has parking provision for at least 12 vehicles and a turning area. The building now forms three units which employ two persons per unit. The 12 parking spaces, therefore, provide sufficient provision for staff.

“In terms of visiting members of the public the beauty salon operates on an appointment only basis and based on its small scale can only accommodate two customers at any one time. Therefore, ample parking provision exists to visitors.

“With regard to the chocolate manufacturing and commercial laundrette service these enterprises do not attract visitors but do attract the dropping off laundry and delivery of associated inputs. Drop off and collections associated with the laundry services tend to fall in line with holiday accommodation changeover days, for example Tuesday drop off and collections on the Thursday.

“With regard to the chocolate manufacturing ingredients are delivered by couriers and movements associated with this is also estimated at 10 vehicular movements per week.”

The application will be considered by county planners at a later date.

Business

First Minister criticised after ‘Netflix’ comment on struggling high streets

Government announces 15% support package but campaigners say costs still crushing hospitality

PUBS, cafés and restaurants across Wales will receive extra business rates relief — but ministers are facing criticism after comments suggesting people staying home watching Netflix are partly to blame for struggling high streets.

The Welsh Government has announced a 15% business rates discount for around 4,400 hospitality businesses in 2026-27, backed by up to £8 million in funding.

Announcing the package, Welsh Government Finance Secretary Mark Drakeford said: “Pubs, restaurants, cafés, bars, and live music venues are at the heart of communities across Wales. We know they are facing real pressures, from rising costs to changing consumer habits.

“This additional support will help around 4,400 businesses as they adapt to these challenges.”

The announcement came hours after Eluned Morgan suggested in Senedd discussions that changing lifestyles — including more time spent at home on streaming services — were contributing to falling footfall in town centres.

The remarks prompted political backlash.

Leader of the Welsh Liberal Democrats, Jane Dodds, said: “People are not willingly choosing Netflix over the high street. They are being forced indoors because prices keep rising and wages are not.

“Blaming people for staying at home is an insult to business owners who are working longer hours just to survive.”

Industry groups say the problem runs deeper than consumer behaviour.

The Campaign for Real Ale (CAMRA) welcomed the discount but warned it would not prevent closures.

Chris Charters, CAMRA Wales director, said: “15% off for a year is only the start. It won’t fix the unfair business rates system our pubs are being crushed by.

“Welsh publicans need a permanent solution, or doors will continue to close.”

Across Pembrokeshire, traders have repeatedly told The Herald that rising energy bills, wage pressures and rates — rather than a lack of willingness to go out — are keeping customers away.

Several town centres have seen growing numbers of empty units over the past year, with independent shops and hospitality venues reporting reduced footfall outside the main tourist season.

While ministers say the relief balances support with tight public finances, business groups are calling for wider and longer-term reform.

Further debate on rates changes is expected later this year.

Business

Pub rate relief welcomed but closures still feared

CAMRA warns one-year discount is only a sticking plaster as many Welsh locals face rising bills

A BUSINESS rates discount for Welsh pubs has been welcomed as a step in the right direction — but campaigners warn it will not be enough to stop more locals from shutting their doors.

The Campaign for Real Ale (CAMRA) says the Welsh Government’s decision to offer a 15 per cent reduction on business rates bills for the coming year will provide short-term breathing space for struggling publicans.

However, it believes the move fails to tackle deeper problems in the rating system that continue to pile pressure on community pubs across Wales, including in Pembrokeshire and Carmarthenshire.

Chris Charters, Director of CAMRA Wales, said: “Today’s announcement from the Finance Secretary that pubs will get 15% discount on their business rates bills is a welcome step.

“However, many pubs still face big hikes in their bills due to the rates revaluation which could still lead to more of our locals in Wales being forced to close for good.

“15% off for a year is only the start of supporting pubs with business rates. It won’t fix the unfair business rates system our pubs are being crushed by.”

He added: “Welsh publicans need a permanent solution, or doors will continue to close and communities will be shut away from these essential social hubs that help tackle loneliness and isolation.”

Mounting pressure on locals

Under plans announced by the Welsh Government, pubs will receive a temporary discount on their rates bills for the next financial year.

But CAMRA argues that many premises are simultaneously facing sharp increases following the latest revaluation, which recalculates rateable values based on property size and trading potential.

For some smaller, rural venues, especially those already operating on tight margins, the increases could wipe out the benefit of the relief entirely.

Publicans say they are also contending with rising energy costs, higher wages, supplier price hikes and changing customer habits since the pandemic.

In west Wales, several long-standing village pubs have either reduced their opening hours or put their businesses on the market in the past year, with landlords warning that overheads are becoming unsustainable.

Community role

Campaigners stress that the issue goes beyond beer sales.

Pubs are often described as the last remaining social spaces in small communities — hosting charity events, sports teams, live music and local groups.

In parts of rural Pembrokeshire, a pub can be the only public meeting place left after the loss of shops, banks and post offices.

CAMRA says supermarkets and online retailers enjoy structural advantages that traditional pubs cannot match, making it harder for locals to compete on price.

The organisation is now calling on ministers to introduce a permanently lower business rates multiplier for pubs, rather than relying on short-term discounts.

Long-term reform call

CAMRA wants whoever forms the next Welsh administration to commit to fundamental reform of the rating system, arguing that pubs should be recognised as community assets rather than treated like large commercial premises.

Without change, it warns, the number of closures is likely to accelerate.

Charters said: “This is about protecting the future of our locals. Once a pub shuts, it rarely reopens. We can’t afford to lose any more.”

For many communities across west Wales, the fear is simple: temporary relief may buy time — but it may not be enough to save the local.

-

Health6 days ago

Health6 days agoConsultation reveals lack of public trust in health board

-

News1 day ago

News1 day agoPrincess of Wales visits historic Pembrokeshire woollen mill

-

Crime5 days ago

Crime5 days agoPembroke man accused of child sex offences sent to Swansea Crown Court

-

Community7 days ago

Community7 days agoCampaign to ‘save’ River Cleddau hits over 2,200 signatures

-

Health3 days ago

Health3 days agoDoctor struck off after sexual misconduct findings at Withybush Hospital

-

News7 days ago

News7 days agoWelsh Conservatives push for reversal of 20mph limit and major road spending

-

Health7 days ago

Health7 days agoAmbulance called after ‘drop of mouthwash’ swallowed as 999 abuse highlighted

-

Crime5 days ago

Crime5 days agoManhunt intensifies after woman seriously injured in Carmarthen park stabbing